lincoln ne sales tax increase

800-742-7474 NE and IA. The Nebraska state sales and use tax rate is 55 055.

Nebraska Sales Tax Rates By City

A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements.

/https://s3.amazonaws.com/lmbucket0/media/business/market-st-ne-fort-lincoln-dr-ne-5454-1-VTSyZk1ie38aAVm7y1qGXQArbenvcgbOU_BwqhVWIXU.97c56f2b80fc.jpg)

. Cigarettes are also subject to Nebraska sales tax of approximately 028 per pack which adds up to a total tax per pack of 092. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four.

Automating sales tax compliance can. You can print a 725 sales tax table here. Lincoln NE 68503 402 467-4321.

It was approved. The December 2020 total local sales tax rate was also 7250. Lincoln ne sales tax increase Monday March 21 2022 Edit.

Construction of four fire stations. The Nebraska sales tax rate is currently. Has impacted many state nexus laws and sales tax collection requirements.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective. YORK The citys sales tax receipts for the month of February came to the highest total for a. One will be a joint policefire station.

025 lower than the maximum sales tax in NE. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public safety projects. There are sales tax rates for each state county and city here.

What is omaha ne sales tax. This is the total of state county and city sales tax rates. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Lincoln Ne Sales Tax Rate 2018. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

The Nebraska state sales and use tax rate is 55 055. This hotel is located in a city with a 175 city sales tax and in a county with a 4 county lodging tax. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

A coalition of community leaders today said a quarter-cent sale tax for streets is needed to keep Lincoln strong and growing. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. Wayfair Inc affect Nebraska.

Lincoln NE 68509. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. Lincoln Ne Sales Tax Rate Mei 15 2021.

The city took in 38965023 for the general. To review the rules in Nebraska visit our state-by-state guide. The Nebraska state sales and use tax rate is 55 055.

The sales tax increase would generate about 13 million a year for a total 78 million for. Replacement of the Citys emergency 911 radio system. More information for.

The Lincoln sales tax rate is. It was a close vote but Lincoln residents will see a quarter cent sales tax increase on October 1. The current total local sales tax rate in Lincoln NE is 7250.

A no vote was a vote against authorizing the. Lincoln is the capital city of the us. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Lincolns City sales and use tax rate will increase from 15 to 175 on October 1 2015. There are no changes to local sales and.

The Nebraska state sales and use tax rate is 55 055. The group is asking the City Council to place on the April 9 primary ballot a measure to raise the City sales tax one-quarter cent for six years starting October 1 2019. The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director.

The Lincoln County sales tax rate is. There is no applicable county tax or special tax. The County sales tax rate is.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincolns City sales and use tax rate increase. Lincoln voters approved the 14-cent increase in April to support two important public safety projects.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1. Did South Dakota v. For tax rates in other cities see Nebraska sales taxes by city and county.

Lincoln Details Lincoln NE is in Lancaster County. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to. What is the sales tax rate in Lincoln Nebraska.

800-742-7474 NE and IA. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. It was a close vote but.

The Nebraska state sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

Lincoln Ne Gov City Of Lincoln And Lancaster County Coronavirus Covid 19 Business Resources

Topped Out Lied Place Residences In Line For More Tif Money Local Business News Journalstar Com

Nebraska And Local Sales And Use Tax Return Form 10 Pdf Fpdf Doc

/https://s3.amazonaws.com/lmbucket0/media/business/market-st-ne-fort-lincoln-dr-ne-5454-1-VTSyZk1ie38aAVm7y1qGXQArbenvcgbOU_BwqhVWIXU.97c56f2b80fc.jpg)

T Mobile Market St Ne Fort Lincoln Dr Ne Washington Dc

Can You Avoid Capital Gains Tax In Nebraska Element Homebuyers

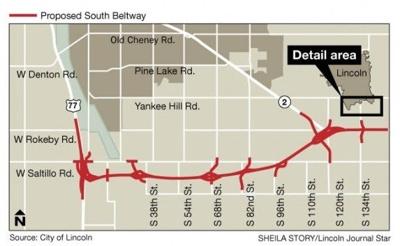

City Making Commitment To Fund Share Of South Beltway Local Government Journalstar Com

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

To Turn Promises Into Policy Maryland Democrats Need Funding Plans One Suggestion Raise Taxes Guest Commentary Baltimore Sun

Nebraska Sales Tax Small Business Guide Truic

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Register Your New Business Online Nebraska Department Of Revenue

Nebraska S High Property Taxes Put A Damper On Land Sales Thefencepost Com

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price