how much will my credit score increase with a car loan

If you have a five-year car loan for. In a nutshell the FICO credit scoring formula the most commonly used scoring.

Here S The Average Auto Loan Interest Rate By Credit Score Loan Term And Lender Loan Interest Rates Car Loans Car Loan Calculator

It augments your payment history raises your total amount owed adds another figure to your average credit age and contributes an additional credit type to your portfolio.

. Unfortunately when you first pay off your car your credit score will slightly go down and will not increase. It basically combines the advantages of a RRSP and a TFSA into one account so you can save up to 8000 per year up to 40k and reduce your taxes owing like an RRSP PLUS you dont pay. Once you pay off a car loan you may actually see a small drop in your credit score.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. It doesnt matter how bad your credit history is we look at your potential to repay. However as you begin making on-time payments on the loan your credit score should bounce back.

Your credit score may also affect your down payment amount. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. How Much Will Credit Score Increase After Paying Off My Car.

Your credit score is higher. This accounted for 50 of my installment utilization. After a year of.

When you make payments on time it. When you visit a dealer and decide to purchase a car fill out the loan paperwork and give the dealer permission. As a result the amount you owe will reflect as 0 which could lower.

Unlike the standard FICO score range 300850 the range for FICO Auto Scores is 250900. Your credit score will not increase after paying off your car loan. The prime borrower will pay about 1614.

The impacts of a car loan start with the first inquiry on your credit score. When you pay off your auto loan you no longer have monthly payments and you dont owe anything else. Ad Read Expert Reviews Compare Your Car Financing Options.

Building your credit score above 780 puts you into the superprime range which means you can get the best rates possible. Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan. Compare Apply Today.

While a car loan paid on-time will ultimately help increase your credit score its a long-term plan that needs your full commitment. Throughout your life you build a credit score which can change over time. How much does your credit score increase after paying off a car.

Over time the subprime borrower will pay back 15164 or 5164 in interest. Lenders usually decide upon loan approval based on your credit score. The prime borrower is offered the average 605 rate.

If you increase your credit score significantly in the 12 months or so after taking out a car loan you may qualify for loan offers with better interest. The car loan remains on your credit for the life of the loan plus another 10 years. The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the MyFICO website.

Its now at 666 fair. Free Credit Monitoring and Alerts Included. You make all of your payments on.

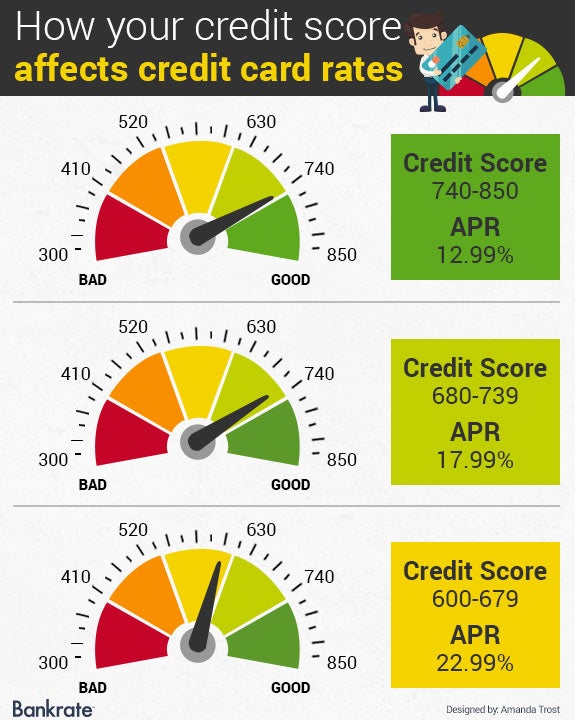

If you already have a credit score in the 800s and you make payments on a car loan it wont increase much because the highest score is 850. Those with lower credit scores will be faced with higher interest rates. Insurance has paid me and my lender.

As you make on-time loan payments an auto loan will improve your credit score. There are five factors that. If a payment is late its recorded as 30 60 90 or 120 days late.

How applying for a new auto loan will impact your credit score. If you need help finding the best auto. However if you want to get there with.

From my own experience paying off several auto loans whenever I. Buying a car can help your credit if. But if you have a low credit.

Free Credit Monitoring and Alerts Included. New Credit Scores Take Effect Immediately. My new utilization should be roughly 6 I also recently had my 45k vehicle totaled out.

Oftentimes paying off a car loan will results in a decrease in. Your score will increase as it satisfies all of the factors the. Those with lower credit scores will generally be required to.

The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the myfico website. New Credit Scores Take Effect Immediately. Ad Raise your Credit Scores Instantly by Paying Your Utility Phone Bills on Time.

Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders. Ad If you have bad credit no credit bankruptcies or even repos were the answer. Your payment history makes up a very large portion of your credit mix.

Here is how its calculated. 2 These scores are affected by similar factors as your regular FICO score but. The good news is financing a car will build credit.

Ad Raise your Credit Scores Instantly by Paying Your Utility Phone Bills on Time.

What Credit Score Is Needed To Buy A Car Lendingtree

What Is A Credit Score How To Improve Your Credit Score Improve Your Credit Score Credit Score Good Credit Score

Credit Score Your Number Determines Your Cost To Borrow

How To Increase A Credit Score To 800 5 Proven Tips Credit Repair Business Credit Repair Companies Credit Score Repair

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Saving Strategies

What Credit Score Do You Need To Get A Car Loan

Pin On Automobiles Motorcycles Atv Dirt Bikes

What Does Your Credit Or Cibil Score Say About You Improve Your Credit Score Good Credit Score Free Credit Score Check

What S The Minimum Credit Score For A Car Loan Credit Karma

How Much Is Cibil Score Required To Finance Your Car Credit Score Bad Credit Score Scores

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Good Credit

What S The Minimum Credit Score For A Car Loan Credit Karma

Does Financing A Car Build Credit

Average Auto Loan Interest Rates Facts Figures Valuepenguin

Credit Score Needed To Buy A Car In 2021 Lexington Law